Author,

26/11/2023, 7 Minutes Read

As a global economic and tourist hub, Dubai entices millions of visitors each year. Many are enthusiastic about making Dubai their home after experiencing it.

Dubai’s year-round sunshine, economic and political stability, a liberalized visa regime and business and investor-friendly environment, are inspiring a growing number of expatriates to live and invest here.

However, once you decide to call the city home, the question remains – should you rent or buy a property in Dubai? Let’s look at the advantages and disadvantages of renting a property in Dubai, typical rental rates and property prices in different areas, trends, and factors in the Dubai real estate market, and legal and contractual considerations.

4 Factors to Consider Before Renting or Buying a Property in Dubai

There are several great options to rent or buy property in Dubai – you can choose from apartments, villas, seaside homes, gated communities and more. However, when deciding whether to rent or buy a property in Dubai, keep these four essential factors in mind.

1- Your finances

One of the primary factors behind the decision to rent or buy is your financial situation. If you envision staying in Dubai for an extended period or building equity through property ownership, home ownership could be the right path.

If you have substantial savings and/or can secure a mortgage loan, buying a property in Dubai can be a viable option. However, upfront costs such as down payments, registration fees, and associated taxes can represent a considerable financial outlay.

On the other hand, if you prefer a lower initial financial commitment, greater liquidity or are only in Dubai for the short-term, renting offers freedom and convenience.

2- Market Analysis

Dubai's real estate market is dynamic and can be influenced by various factors, including supply and demand, economic conditions, and government policies. Before making a decision, do your homework and conduct market research. Analyze trends, consult real estate experts, and other home owners, and review property prices and rental rates in different areas of the city. This will help you understand market stability, potential appreciation, and rental yields, so you reach an informed decision.

3- Lifestyle and Flexibility

Consider your desired lifestyle and the level of flexibility you require. Owning a property offers stability and the freedom to customize and personalize your living space. It also allows you to build a sense of belonging and community. For instance, if you are setting up a business which you expect to grow in the long-term, buying a property in Dubai might be more suitable than renting. However, if you are a couple embarking on a new life, it may be better to consider renting a property in Dubai for a few years to get a better idea of your priorities and goals. Carefully evaluating a range of factors will help you make an informed decision that aligns with your individual needs.

Conversely, renting provides flexibility, especially if you prefer to explore different areas or easily modify your living arrangements. Additionally, some rental properties come furnished, which can be convenient for those with short-term plans or who prefer not to invest in furniture.

4- Maintenance and Responsibilities

Financial spending does not end with moving into your home – there are also lifelong associated costs such as repairs, maintenance, property management, and other related tasks. Renting has the advantage of having maintenance and repairs handled by the property owner or management company.

Pros and Cons of Renting a Property in Dubai

Renting a property in Dubai offers distinct advantages. There are many great options to rent in Dubai based on your lifestyle and budget.

The most obvious benefits are flexibility, financial freedom, and fewer upfront costs. The best part about renting a property in Dubai is that you are not tied down to long-term commitments. The tenant is also relieved of the responsibility of property maintenance and repairs.

However, renting lacks the potential for long-term financial returns, as the money spent on rent does not contribute to building equity or ownership. In the long run, many tenants feel overburdened by the amount they have spent on rent.

Assessing your priorities and paying close attention to the advantages and disadvantages is the best way to avoid regrets in the future.

In conclusion, choosing between renting and buying a property in Dubai is a significant decision that requires careful consideration. Assessing your financial situation, long-term plans, market analysis, lifestyle preferences, and willingness to undertake responsibilities will help guide you toward the option that best aligns with your needs and goals. This is [Your Name], reporting from Dubai, signing off.

Trends and Factors to Consider in Dubai Real Estate Market

Dubai real estate is shaped by market trends and factors such as economic growth, government initiatives, and demand and supply, all of which influence property prices and rental rates. Currently, there is a trend of residents upgrading to larger living spaces, especially villas and townhouses, driven by attractive property prices and low mortgage interest rates.

However, investors will find a host of options across various price points, making it easy for people to quickly find the right property. Additionally, the government's efforts to introduce new visa types have positively impacted consumer sentiment, making it an opportune time for first-time buyers to enter the market. It’s easier now than ever before to make the choice between renting or buying property in Dubai.

Legal and Contractual Considerations

When engaging in property investment or transactions in Dubai, it is crucial to understand the legal and contractual aspects involved. These include government fees, such as Dubai Land Department fees, title deed issuance, mortgage registration fees, and potential agency fees if utilising a real estate broker.

Furthermore, consider additional costs like annual service charges, property insurance, and personal factors such as bank loan eligibility, existing liabilities, education for children, and job security. Fortunately, the UAE Government has made it incredibly transparent for consumers, developers and investors to buy or rent, lease or sell property in Dubai.

Whether renting or buying a property in Dubai, both require careful evaluation of key factors, weighing the advantages and disadvantages, understanding rental property rates and downright purchase prices, monitoring market trends, and being aware of legal and contractual considerations. By considering these aspects, you can make an informed decision that aligns with your financial goals and lifestyle preferences in the vibrant city of Dubai. It has never been better to invest in Dubai real estate.

Typical Rental Rates and Property Prices in Different Areas of Dubai

Dubai’s real estate market showcases a diverse range of neighbourhoods, each with its own rental rates and property prices. Given the resurgence of the real estate investment market in Dubai after the pandemic, there are many exciting prospects in new and emerging neighbourhoods.

Property rental rates vary based on factors such as location, property type, size, amenities, and demand. It is advisable to research and compare rental rates and property prices in different areas to determine the affordability and suitability of your desired location. Transport connectivity, access to schools, hospitals and recreation are also key factors to consider.

Dubai's Apartment Rents in 2023: CBRE Report

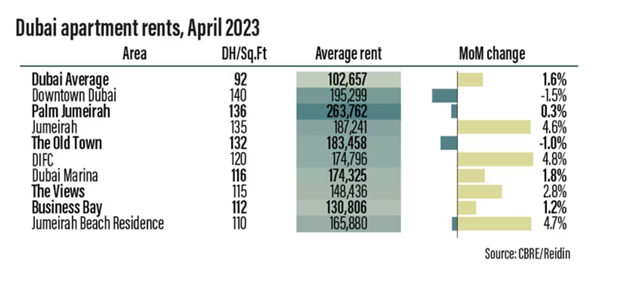

Rents across Dubai apartments vary depending on the location, amenities, size, and proximity to key attractions. The global leader in commercial real estate services and investments – CBRE – publishes the average rents in popular neighbourhoods in Dubai.

Based on data published by CBRE in April 2023, Downtown Dubai, Palm Jumeirah, Jumeirah, The Old Town and DIFC commanded the highest rents for residential apartments. This was followed by DIFC, Dubai Marina, The Views, Business Bay and JBR.

FAQs

Is renting or buying better in Dubai?

Both renting and buying come with their advantages and disadvantages. The best part about renting a property in Dubai is that you are not tied down to long-term commitments. The tenant is also relieved of the responsibility of property maintenance and repairs. However, renting lacks the potential for long-term financial returns, as the money spent on rent does not contribute to building equity or ownership. Residents who have long term plans in in the UAE would be better off buying a home as it works out to be more cost effective and allows more freedom when it comes to renovation and home improvements.

Is it worth buying property in Dubai?

It has never been a better time to consider buying property in Dubai. Real estate in Dubai is more affordable, and despite global economic headwinds, many high-net-worth individuals flocked to the UAE which gave the premium property market a boost. Looking ahead, Dubai’s economic competitiveness is expected to improve even further, making it an opportune time to buy property in Dubai.

Will rent go down in 2023 in Dubai?

Dubai’s residential rental market remains robust and is unlikely to go down in 2023. According to data published by CBRE, average apartment prices rose by 14.5 per cent to Dh1,256 ($342) per square foot and average villa prices rose by 14.9 per cent to Dh1,484 per square foot in the year.