Dubai Waterfront Living: Is Buying a Waterfront Property Worth It?

Summary

Palm Jumeirah is not just a coastal address, it is the benchmark of Dubai’s waterfront appeal.

In 2025, average per-sqft prices on the Palm rose from AED 3,483 → AED 3,668 (a ~5% increase) across prime buildings.

Meanwhile, a record Palm “frond” villa sold at AED 14,679/sqft (≈ AED 161 million), a deal that grabbed headlines as one of Dubai’s highest per-foot transactions.

These data points set the stage: the question isn’t whether waterfront is expensive, but whether it earns its price through daily life, stability and capital resilience.

Pros of Waterfront Living

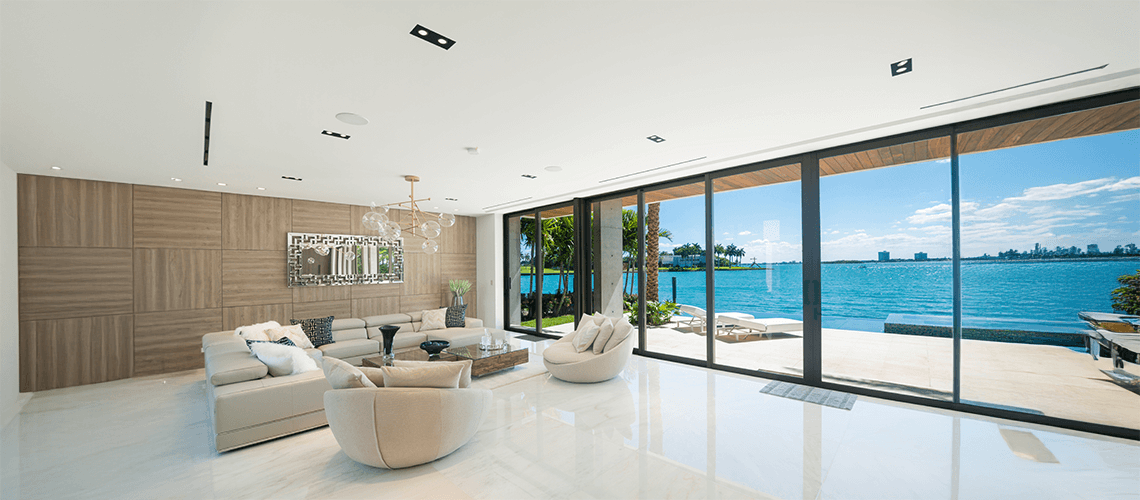

Luxurious Lifestyle

Palm Jumeirah is an island in name, but a city in experience, where every detail is curated for a life of ease, beauty and distinction.

Private coastlines, skyline views and refined amenities make daily living feel cinematic. Residents stroll along palm-lined promenades, dine by the water and unwind to the rhythm of the tide.

This is the essence of Dubai’s luxury, not just wealth, but space, stillness and design that connects to nature.

Tranquility and Wellness

Waterfront life nurtures the body and mind. The gentle sea breeze, walkable promenades, and proximity to open water naturally reduce stress and promote balance.

On the Palm, each residence opens to natural light and sweeping horizon views, creating a visual calm that city interiors can’t replicate.

For many residents, the sea becomes part of their wellness ritual, morning swims, outdoor yoga, or simply watching the waves meet the skyline.

Resort-like Experience

Life on the Palm feels like a year-round retreat. Residents enjoy hotel-level services, private beaches, infinity pools, wellness spas and concierge-managed residences within steps of world-class dining.

Properties like Atlantis The Royal and FIVE Palm Jumeirah set the standard for resort-integrated living, blurring the line between home and getaway.

Every moment here feels curated, from sunset dinners on terraces to a morning run along the shoreline.

Strong Investment Potential

Waterfront properties continue to outperform the wider market.

Waterfront properties continue to outperform the wider market, driven by limited coastline and sustained global demand. In 2025, Jumeirah Bay Island saw a 24% annual price increase, reaching AED 4,122 per sq. ft, while Palm Jumeirah recorded a steady 5% rise, from AED 3,483 to AED 3,668 per sq. ft.

High-end villas on the Palm now average AED 6,912 per sq. ft, with typical transactions exceeding AED 47 million, and one record-breaking sale reaching AED 161 million (Gulf News, 2025).

Real Returns: Palm Jumeirah in Focus <H4>

Over the past five years, Palm Jumeirah villas have appreciated by 146%, one of the sharpest increases across Dubai’s prime coastal markets.

Current valuations show villas trading at around AED 6,028/sq. ft, up from roughly AED 4,074/sq. ft just two years ago, underscoring consistent capital growth even in a maturing market.Meanwhile, Palm Jumeirah ranked among Dubai’s top-performing villa districts, posting a 40.5% year-on-year rise in 2025 alone.

For apartments, average annual rental yields range between 5.5% – 7%, with seasonal occupancies above 85%, according Unique Properties (2025). These numbers reflect how limited supply, global demand and lifestyle appeal combine to sustain long-term value.High Demand

Dubai’s waterfront real estate remains a top-performing segment, driving nearly half of all prime sales value in 2025.

In H1 2025, the city’s total sales value surged 40.1% year-on-year, led by prime coastal communities.

Palm Jumeirah remains the crown jewel, a safe haven for high-net-worth individuals seeking security, exclusivity and prestige. Deloitte’s Real Estate Predictions 2025 cites Dubai’s coastal assets as key drivers of resilience, backed by international migration and investor confidence.

This means that, it’s not just about owning a home by the sea, but more about belonging to one of the world’s most sought-after addresses, where demand continues to outpace supply.

Cons of Waterfront Living

1. High Entry & Maintenance

Buying premium lines, especially those with direct “water-to-wall” views, demands a premium both in capital and upkeep: salt-exposed glazing, beachside cladding, façade cleaning, service charges, these are real line items. Even in luxury precincts, not all stacks are equal; choosing the right line is non-negotiable.

2. Limited Options & Timing Risk

Most of the best waterfront parcels on the Palm have been allocated. New launches are rare and often pre-sold rapidly. Buyers must act early, and miss the right line, and your home might face view obstructions or inferior orientation.

Cons of Waterfront Living

Palm Jumeirah

Still the icon.

Recent data: villa asking prices average AED 6,095/sqft.

In January 2025, villa stock averaged AED 6,912/sqft, with average sales exceeding AED 47 million.

Plus a land plot sold for AED 365 million in 2025, reinforcing how every parcel here is elite.

The island is self-sufficient: retail, restaurants, schools, hotel nodes, yet remains isolated in experience.

Dubai Marina / JBR / Bluewaters

Dubai Marina’s 7-km promenade and 200+ towers create one of the city’s densest rental hubs.

Marina also reports average rental yields of 6–7% in prime towers.

JBR adds the waterfront strip called The Walk (1.7 km retail/beach frontage) which connects dining, shopping, and surf.

Jaddaf / Canal / Creek-side

While not true beachfront, canal and creek-edge communities offer water adjacency with tighter access to Downtown, a mix of boutique waterfront living, walkways, bridges and emerging marina infrastructure.

The Dubai Canal is a 3.2 km waterway integrated with walkways, marinas, retail and bridges

Waterfront Apartments in Dubai

These often live in towers on Palm, Marina, Dubai Harbour and Bluewaters. Because they sit on rare waterfront lines, prices can exceed average by 25–50%. In 2025, both portal traffic and search volumes have shifted heavily toward these addresses.

Leasing is robust in coastal areas due to lifestyle pull and tourism, which supports occupancy well into off-peak months.

Waterfront Villas in Dubai

At the pinnacle, villas on Palm fronds, Jumeirah Bay and exclusive beachfront lots are traded in the tens or hundreds of millions.

Their value stems from plot, orientation, landscaping, privacy and horizon exposure, not just square footage. A villa deal at AED 14,679/sqft was among 2025’s record sales.

Conclusion

Owning waterfront in Dubai isn’t just a status move, it carries real value when chosen smartly.

The margins are higher, but so are the lifestyle dividends: daily access to the sea, views in every direction and environments designed to be walked, lived and experienced.

If your budget accounts for the premium, and you invest wisely in view, orientation and quality construction, waterfront property can deliver both lifestyle richness and investment resilience.

In other words: yes, it’s often worth it. Just don’t buy anywhere; buy the right line, right horizon, right community.

FAQs:

Is Dubai's waterfront a good place to live?

Yes. Dubai’s waterfront communities, especially Palm Jumeirah, Dubai Marina and Bluewaters, offer privacy, resort-style amenities and strong connectivity. Residents enjoy sea views, calm surroundings and a vibrant social scene, while property values and quality of life consistently outperform inland districts. It’s both a lifestyle and investment choice.

What is waterfront living?

Waterfront living means residing directly along the sea, canal, or marina, where architecture meets nature. It combines scenic views, natural light, and access to water-based leisure like beach clubs and promenades. In Dubai, it represents a calm, upscale way of life blending wellness, convenience and design in equal measure.

Do waterfront properties offer good rental yields?

Yes. Waterfront apartments in Dubai average 5.5%–7% annual yields, with occupancy rates above 85%, outperforming many inland areas. The scarcity of beachfront plots and strong tourism demand ensure high rental premiums, making these assets reliable for long-term income and appreciation.